Gone are the days when consumers have to pay visits to banks to get their finance-related work done. The digital times now have facilitated everything from opening a bank account to carrying out transactions i.e. all can be done through online portals. Consumers of all ages acknowledge the usefulness and convenience that digital banking has brought with it. To keep raising the bar and to better facilitate their customers, banks and other financial institutions are heading towards more advanced and updated technology protocols. Imposters like always are not getting behind in the race and are coming up with sophisticated ways to bypass the tech-driven processes. Hence, banks are practicing customer due diligence to remain a step ahead of the fraudsters.

It is absolutely true that the digitized world has eased the way we used to deal with financial processes but it is also right to say that it has paved the way for more advanced scams. It is reported that money laundering and terrorist financing are the most prevailing type of fraud these days. Lack of customer due diligence protocols can not only cost banks to lose their reputation but they also have to pay heavy fines and penalties in case of non-compliance.

The aftermath of non-compliance for the Banks

Failure to comply with CDD and EDD in banking could negatively affect the banks and financial institutions. Inadequate and loopholed customer due diligence enables the bad actors to use banking security protocols to perform illegal activities.

Data theft

Being non-compliant to the customer due diligence for banks means the organizations do not possess a stable security system to safeguard information. This will consequently allow the imposters to carry out security breaches and identity theft. Moreover, it may cause the banks to face adverse financial as well.

Heavy Fines

Banks that do not bother to follow customer due diligence to comply with KYC have to experience hefty penalties eventually. The fines are decided on the volume of transactions being carried out, and the level of non-compliance.

Destroyed Reputation

ID theft, data breaches, and the name associated with Fincrimes not only have adverse impacts on the firm but also destroy the reputation of the respective organization. Once the security protocols like customer due diligence are sacrificed, it gets very difficult for the banks and other financial institutions to earn trust in the eyes of consumers.

Revenue loss

After the image of the business is damaged, it will consequently affect the financial institutions’ sales and revenue. Moreover, illegal activities can have the banks compromise their satisfied consumers, resulting in a decrease in revenue.

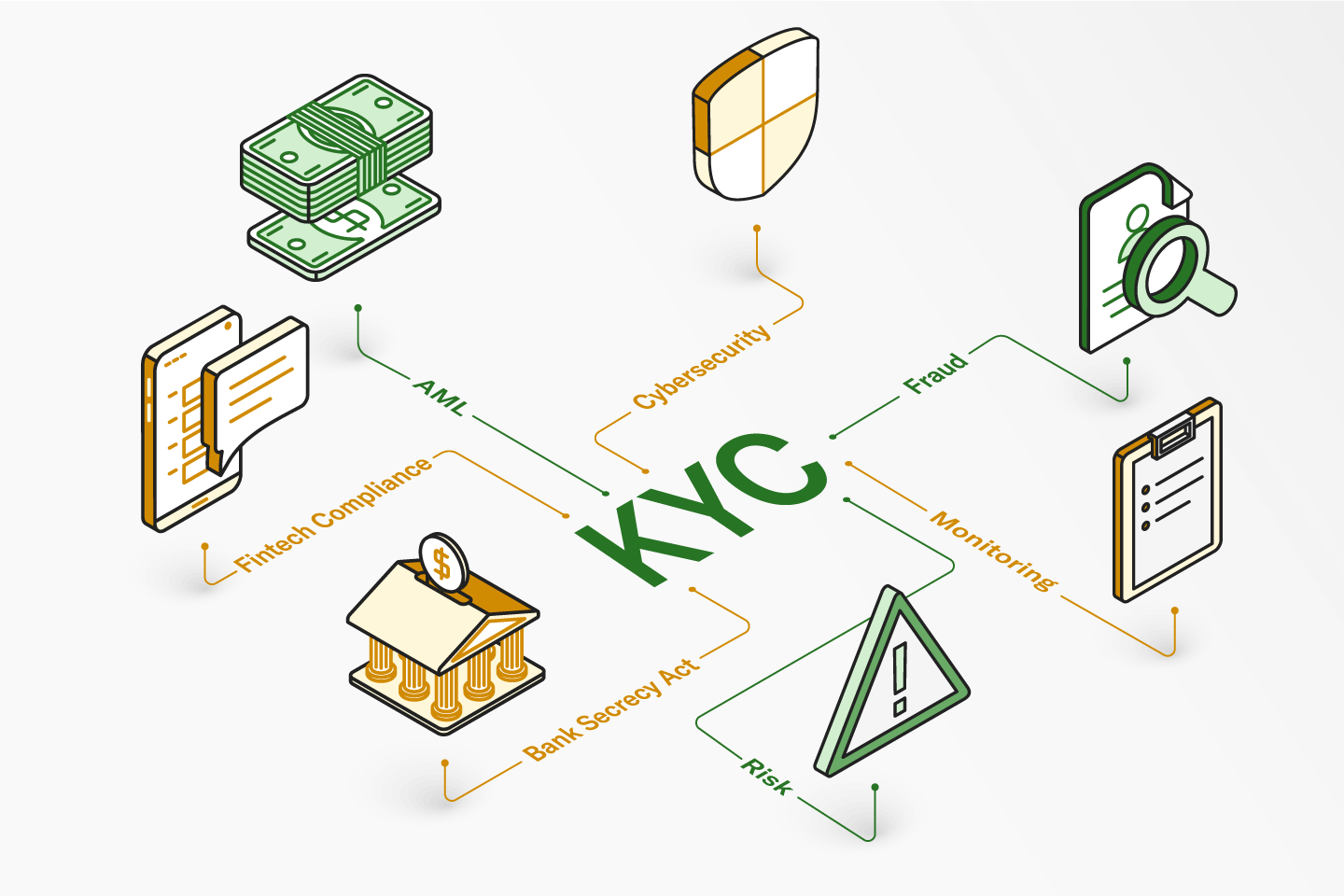

KYC Due Diligence for Banks

For banks, the Know Your Customer (KYC) checks can be performed by CDD (Customer Due Diligence) and EDD (Enhanced Due Diligence) to comply with the AML (Anti-money Laundering) regulations and to save themselves from bad actors or fraudsters.

Due diligence financial is a significant part of the know your customer (KYC) protocols that offer a big level of investigation of potential risk-possessing customers, and ultimate beneficial owners through CDD. Enhanced due diligence is the next level of customer due diligence and delivers a higher level of ID confirmation by acquiring consumers’ identity and consequently, examining the risk of clients.

Risk management methods are categorized based on the clients’ risk profiles. It starts with the steps to verify who you are dealing with, identify their activities, and evaluate the risk of financial crime like money laundering. To fight the plays of bad actors and to secure the clients’ funds, banks and other financial institutions are responsible to comply with EDD measures.

FATF Risk-Based Approach For Banking Sector

Banks often deal with customers that need customer due diligence measures. For these consumers, the Financial Action Task Force (FATF) advised a risk-based approach “the amount of information collected, and the level to which the data is verified, must be checked where the risk associated with the client is greater.”

There are other advantages of the risk-based approach; it can be conveniently exercised by the financial institution, it identifies the consumers and the risk linked with them completely, and its ability to adapt as technology, circumstances, and other aspects alter.

Conclusion

As they are directly associated with dealing with the monetary processes, banks and other financial institutions are sensitive to facing Fincrimes. Compliance professionals keeping in view the rising trends in money laundering and terrorist financing have designed the advanced KYC and AML regulations. Customer due diligence is part of the KYC process that assists banks to get the identity verification processes done. FATF has developed this risk-based approach in order to prevent banks from facing money laundering and other finance-related crimes.